ALTO Investment

Manage all assets in a global end-to-end platform

Best-of-breed technology that fits your business requirements, with rich functional coverage across the investment management value chain and deep industry expertise.

€2.5tn

Assets under management on the platform

50+

Global Clients incl. Leading Asset Managers

5K+

ALTO Investment users

250+

Execution counterparties

ALTO Investment: Tailored, Seamless, Innovative

Keep pace with change

Break down barriers to change with Core Investment Management Platforms that support the pace of innovation

Tailored to your needs

Adaptable solutions for stability, scalability, and innovation to meet your operational needs and gain a competitive advantage

Transform at scale and cost

Embrace innovation with our cloud native platform, free from legacy constraints, enabling continuous evolution

Client-focused implementation

Switch platforms with ease using our proven ALTO implementation approach and ongoing tooling development

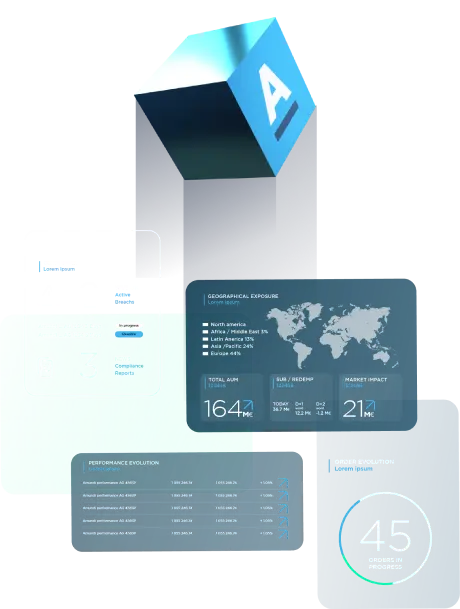

ALTO Investment platform

Answer market expectations

01 Keeping pace with technology change

Continuous innovation investment including AI, tokenisation and digital assets capitalising on emerging technology.

02 Greater data connectivity and open API access

Accelerated deployment and migration with API integrations and a singular data language for rapid implementation.

03 Mitigation of transformation and regulatory risk

A secure solution in line with international compliance and regulatory needs across all your markets.

04 Client-focused implementation

Unique configurations and modular products to fit your operating model and accelerate capability where you need it.

Tailored, modular and integrated solutions

- 100% Cloud-based

- Open architecture

- Inter-operability

Confidence in international compliance

- Direct experience in multi-jurisdictional markets

- International regulatory and security best practice

- Regulation by design

Investment in Innovation

- Dedicated innovation function

- Continuous use case development

- Ongoing investment in emerging tech

Adaptable to your operating model

- Configurable to your ways of working

- Introduce new capabilities at pace

- Productivity and cost reduction built in

Designed for cross-functional teams

Portfolio Manager

Analyse, simulate and take investment decisions on portfolios

Compliance Officer

Define the right rules to detect a breach and act upon it

Risk Officers

Analyse and produce risk metrics, factors, and performance analytics

Middle Officers

Monitor and validate financial positions and flows with all intermediaries

Reporting Officer

Produce fund factsheet and investment management reports for clients

Traders

Execute at the best conditions

A suite of capabilities to cover your full functional requirements

01 Portfolio Management

- Portfolio construction and optimisation

- Portfolio Analysis

- Order management

- Cash management

- Trade Execution

02 Risk and Compliance

- Monitoring of market and liquidity risks

- Embedded investment guidelines

- Pre- and post-trade controls

03 Data Management

- Financial instruments

- Portfolio and products

- Index and benchmark

- Ratings | ESG

- Private and Real assets

- Data quality controls

04 Investment Operations

- Trade and funds processing

- Collateral servicing

- Capital activity

- Corporate actions and income

- Reconciliations

- NAV Control

ALTO Investment

Manage all assets in a global end-to-end platform

Best-of-breed technology that fits your business requirements, with rich functional coverage

cross the investment management value chain and deep industry expertise.

- Portfolio Analysis

- Order Management

- IBOR / ABOR

- ESG Metrics

- Risk & Performance

- Dealing

- Pre and Post Trade Compliance Checks

- Client Reporting

ALTO Wealth and Distribution

Wealth management enabled in a single platform

A scalable end-to-end solution with comprehensive capabilities to suit

retail banking and wealth management firms.

- Model / Target Creation

- Portfolio Optimisation

- Advisory Proposals

- Portfolio Rebalancing

- Risk & Performance

- Client constraints / preference management

- Pre and Post Trade Compliance Checks

- Client Level Allocation

ALTO Sustainability

Invest with purpose and impact

Our cloud-based solution provides a single point of access for all sustainable data,

transforming market analytics into unique ESG datasets.

- ESG Scoring

- Bespoke ESG Indicators

- ESG Metrics

- Biodiversity Metrics

- Climate Reporting

- Impact Measurement

- Managed Data Service

- Regulatory Standards (SFDR, Taxonomy...)

ALTO Asset Servicing

A service providing cutting-edge capabilities

A solution supporting the business of Asset Servicers covering

Investment Compliance Oversight, Portfolio Analysis and Reporting.

- Portfolio Analysis

- Regulatory and Statutory Rule Design

- Breach management workflow

- Monitoring and Controlling breaches

- Client Reporting

- Multiple Data Source Integration

ALTO Employee Savings and Retirement

Manage savings and retirement schemes in a single platform

- Subscription and Redemtion

- Collective & Individual Operations

- Client Onboarding

- Arbitrages & Transfers

- Order Booking

- Documents Publishing

- Regulatory & Fiscal Reporting

- Multi-products and Tax Wrappers